I want to admonish you, gentle reader, that a turning point in our journey has been reached. For those of you who have forgotten the Psychic Apocalypse, please click on the reference link in the header of this blog to refresh your memory … I want to get a bit more serious about this topic and argue, persuasively, I hope, that the challenges of our time are Good News, that it is Just Time for certain experiences and perceptions to occur and for the individual and collective human journeys to change.

{a really useful aside for those who yet to discover that on most browsers Ctrl + enlarges the page, so those of us with senior challenged vision can read almost anything. Ctrl – reduces the size … that’s The Ctrl key held down while pressing the + sign key over at the far right on most keyboards. Mac users probably use that special key you have instead of Ctrl)

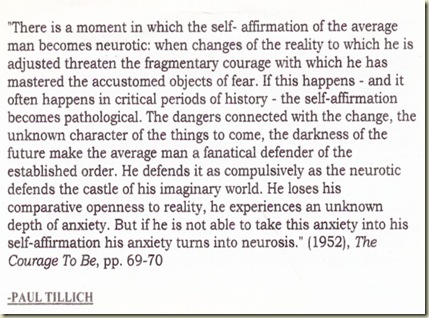

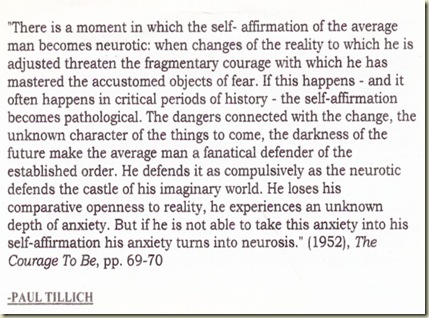

Now the following quote from the theologian who coined the phrase: “Ground of Being” as a modern way to talk about god …

suggests, to me, that we have, here described, a test for how we are doing … that if we are NOT taking refuge in clinging to the past (and failed) we just might be facing the present and emerging future in a useful direction. I would suggest that we are seeing around us the surprising behaviour of many people and groups, in many different contexts to be more like deer in the headlights than like Ku Klux Klansmen … and that if this pause to digest the present perception does not collapse into some kind of reactionary spasm, we might have a chance to navigate our times. And this means you, too … if you are you are not looking for that lost scripture to guide you, but are experiencing a gap in understanding … good on ya!

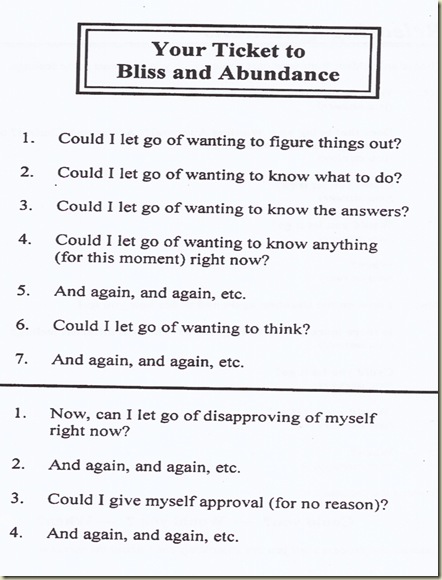

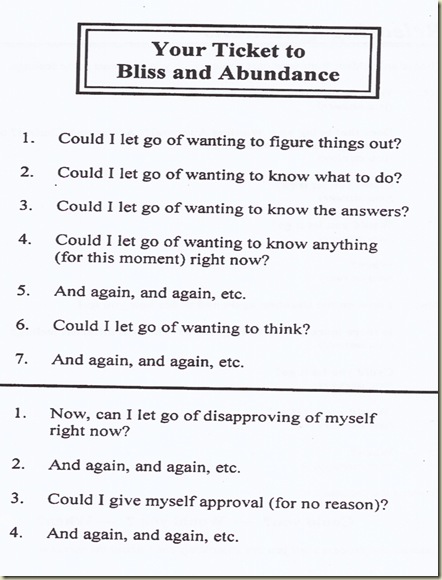

Here is some potential guidance/advice:

This is a summary of the Sedona Method invented by Lester Levinson in 1952 at age 42 when he was told he had 2 weeks to live. In 3 months time, doing the above repeatedly and Releasing everything he could dig out of his unconscious realm, bring it to consciousness and let it go, Lester was healthy, free of dis-ease and lived another 42 years. He would say to himself, “Could you let _____ go?” … “Would you?” … “When?” … one of his disciples has suggested that the answers are Yes, Yes and Now … again and again means to release over and over on that area until it is clear … this is felt experientially.

And finally, lest you think I have gone feeble minded on you, there is some method to my madness … (here you might need to magnify as described above with Ctrl +)

So, perhaps, we can take some heart, dear reader, that the complexities and confusion around us are the inevitable development of a new phase in evolution for humans, our societies and our global culture. Renate asked the wonderful question: Is hyper-inflation possible when everyone is printing money as fast as they can?

_______________ bottom line __________ relative to what?